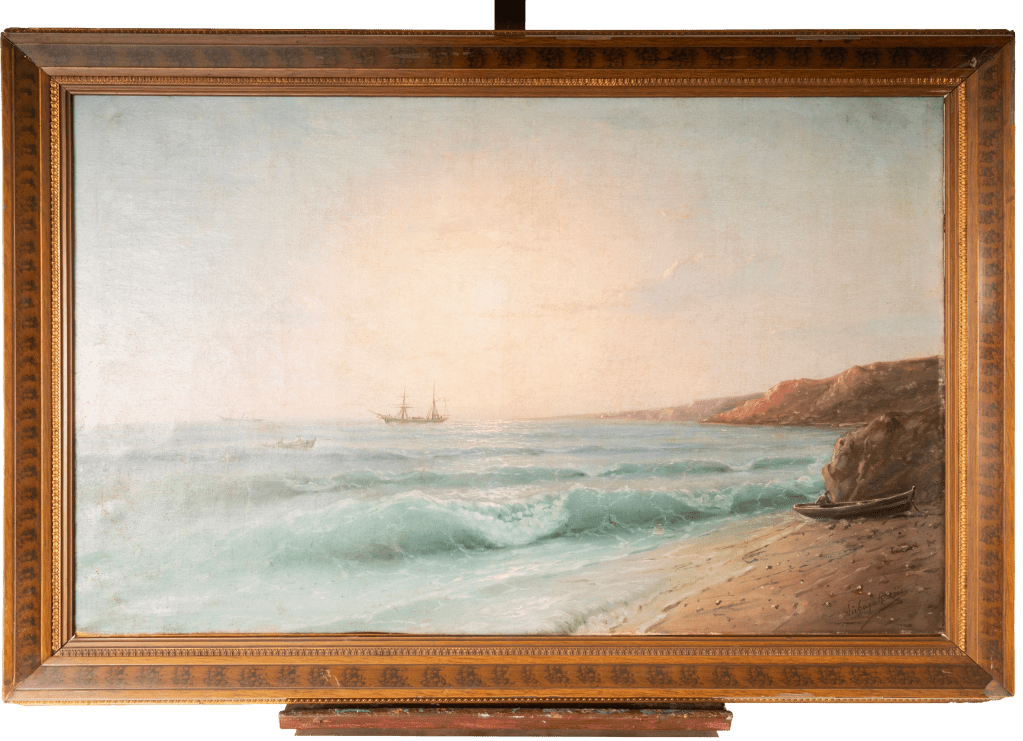

Ivan Konstantinovich Aivazovsky (1817- 1900) has always occupied a singular place in art history — a master of light, a poet of the sea, and one of the most technically gifted painters of the 19th century. For decades, his market has been admired but not fully understood. Yet something important is happening today. Collectors are rediscovering Aivazovsky. The conditions surrounding his legacy are aligning. This makes right now one of the most compelling times to invest in his work.

Unlike many 19th-century artists whose works circulate widely at auction, the strongest Aivazovsky paintings are increasingly absent from public sale. These works stay with private collectors. A significant share of his major seascapes and atmospheric night scenes are in private collections, not institutional holdings. This creates a paradox. As collectors hold onto these works, they become rarer.

For investors, rarity is not just a romantic appeal, it’s a core driver of future valuation. A market with diminishing supply, tends to favor long-term appreciation, especially when demand is global and cross-cultural.

Aivazovsky’s top auction results over the past two decades have shown an unmistakable pattern. There have been significant peaks, followed by market corrections. Then, there is renewed strength. Record prices in London sales (Christie’s and Sotheby’s) show how serious collectors continuously vie for his masterworks. They are particularly interested in large-format seascapes with strong provenance.

Here is what makes the current moment unique: After periods of market consolidation, Aivazovsky values are stabilizing. They are poised for upward movement, particularly for museum-grade works. As art markets shift attention back to historical blue-chip names, collectors are looking for artists with:

- a large but unevenly distributed body of work

- a global reputation

- strong proven performance in major auction houses

- and limited fresh supply

Aivazovsky is one of the few artists whose appeal transcends regions:

- admired by European institutions

- collected heavily in the Middle East

- coveted in Asia

- deeply significant across Armenia, Russia, and the wider region

- recognizable and loved worldwide by maritime-art enthusiasts

Why the Timing Matters Now

Private collectors tend to hold Aivazovsky for decades. As generational transfers take place, fewer major works stay in circulation.

- After years dominated by contemporary art and digital markets, collectors are rediscovering canonical painters with enduring value.

- In uncertain economic cycles, collectors gravitate toward artists with consistent demand and a global collector base.

The ROI Perspective —

Long-Term, Not Speculative

Aivazovsky is a legacy artist, and legacy artists reward:

- long-term holding

- thoughtful acquisition of quality

- provenance-based purchasing

- and strategic timing

Investors with robust strategies are confidently positioning themselves for the next market move. As supply tightens, the competition will undoubtedly ramp up, and those ready will thrive.

A Legacy Worth Entering

Owning An Aivazovsky

Owning an Aivazosky means holding a rare piece of cultural heritage. It is an asset that carries both emotional power and long-term market confidence. For collectors committed to building a lasting portfolio, his work shows one of the most compelling opportunities available today.

More information or to contact visit our site at “Art Investment” Page 🔗 Exclusive For Private Collectors

Leave a comment